How To Register Business For Jobkeeper

Enrol your business for jobkeeper with the ato enrol your business with the jobkeeper payment program via your business portal via mygovid.

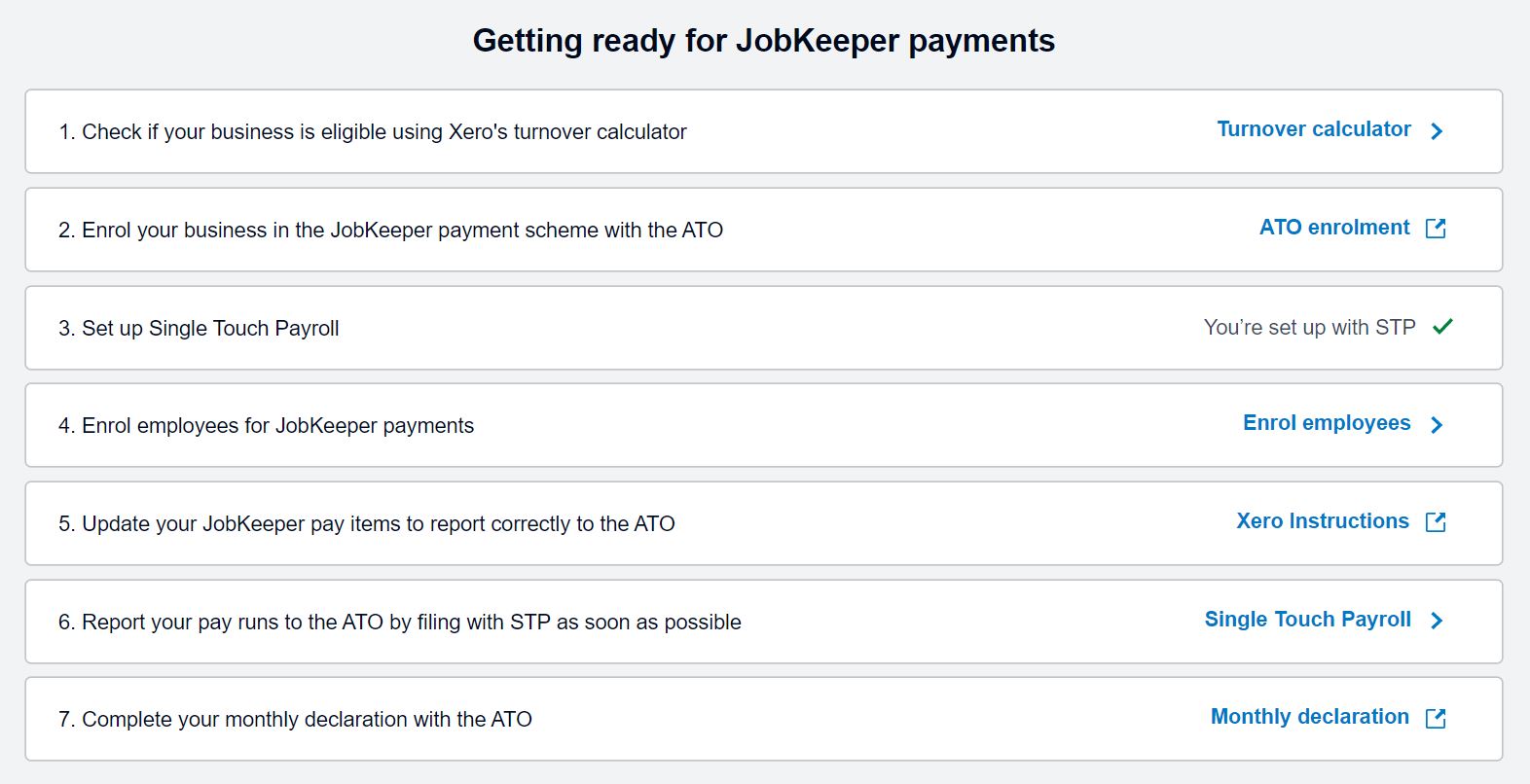

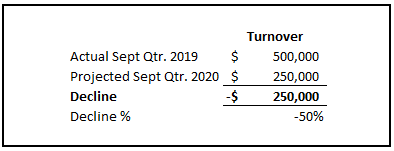

How to register business for jobkeeper. From 4 january 2021 to 28 march 2021 the new decline in turnover form to work out eligibility for the second extension period will be available. David littleproud agriculture minister said this job keeper payment will protect lives and livelihoods at a time of crisis. Setup in your payroll the allowances jobkeeper topup and jobkeeper start fn01 codes and pay all your eligible employees 0 01 in the start allowance to tell the ato this is the first jobkeeper fortnight that your employee is eligible for the subsidy. The jobkeeper payment scheme has been extended until 28 march 2021 see jobkeeper extension. You must do this by the end of april to claim jobkeeper payments for april.

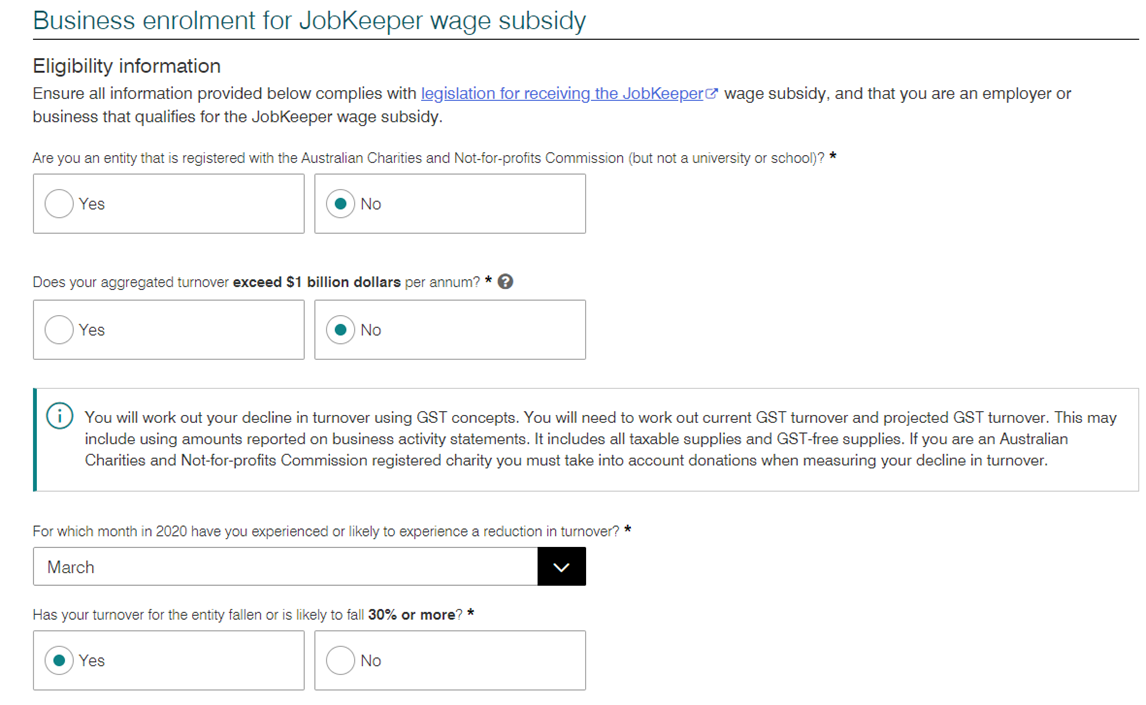

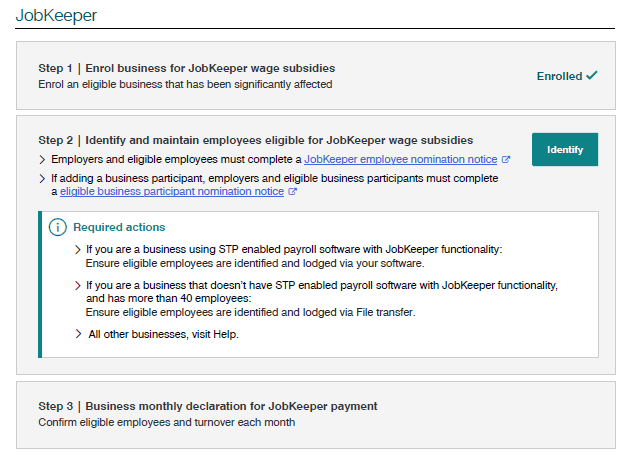

Employers or their accountants need to log into the business portal on the ato s website using their mygovid where they can access jobkeeper enrollment forms. Existing eligible employers must submit the new decline in turnover form before completing their business monthly declarations from 1 february. The jobkeeper payment will be available to eligible businesses including the self employed and not for profits until 28 march 2021. The jobkeeper payment is administered by the australian taxation office ato. The government s 130 billion jobkeeper scheme is the biggest financial lifeline australia has ever seen.

The federal government is moving to provide subsidies to australian businesses to keep the nation s workers employed. You must pay each of your eligible employees at least 1 500 per fortnight while your business is participating in the jobkeeper payment scheme. You can register for jobkeeper on or after 20 april 2020. How to register for jobkeeper monday march 30 2020. The two parts to registering are.

Whilst we believe the information provided is all that you need to manage your participation in the jobkeeper scheme we are able to assist with determining eligibility registering applying and reporting on your behalf. Crucially it will allow small businesses to continue operating and paying their staff. The following is a step by step action plan for any eligible business wishing to participate in the jobkeeper program. Eligible business participant jobkeeper i m also trying to add a director for jobkeeper. You ll need to provide each employee with a jobkeeper employee nomination notice form that they ll need to complete and return to you or your registered tax or bas agent as soon as possible.

The jobkeeper payment is a scheme to support businesses and not for profit organisations significantly affected by covid 19 to help keep more australians in jobs.